About Us

About Us

Crowd funding is the new way to invest in startups! Ours is a unique equity crowd funding platform focused on connecting investors with a host of extremely promising Indian start-ups and early stage ventures, with an array of capital solutions and co-investment commitment. For a start-up, with an incredible business idea, we will not only help raise capital, but will also provide access to a pool of illustrious mentors and effectual partners who can help nurture the business to its potential.

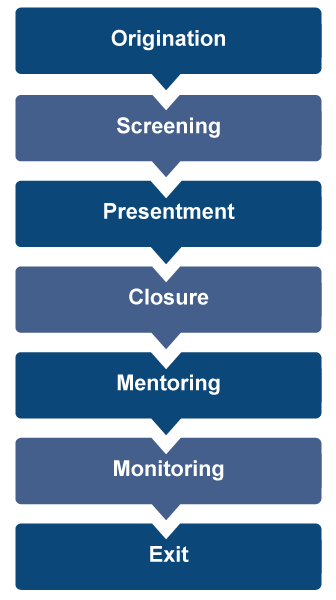

What differentiates us from others is our unique ecosystem that has been built around “commoditized” fundraising. Our range of services includes deal origination and sourcing, structuring the capital raising, guidance on building business plans and financial models, screening proposals, carrying out due diligence, providing access to investor members and presentment, deal closure, mentoring, and post investment monitoring.We co-invest in companies that raise capital through our platform. We are also in the process of launching a suite of exclusive capital solutions for start-ups, early stage ventures and investors.

Team

Team

Anup Kuruvilla has over 35 years of experience in arranging debt for corporate clients across emerging Asian markets with a primary focus on India, Indonesia and China. He has been based in Mumbai for 9 years, Singapore for 7 years, Hong Kong for 10 years and Jakarta for 4 years, working with Citibank, Chase Manhattan and ABN Amro / RBS. His last assignment was as the Managing Director and head of RBS’s Loan Syndication activities in Hong Kong (till Oct, 2014).

Anup has been involved in over 500 transactions (over US$ 100 billion in value) across the whole spectrum of debt ranging from short term trade financings, acquisition bridges and leveraged financings, medium term working capital / capex facilities and long term project as well as ECA finance through both the bank and bond markets. He holds an MBA from XLRI Jamshedpur and is a member of the Institute of Chartered Accountants of India. |

Anil Gudibande has over 27 years of experience in Banking. He spent 17 years with Citigroup and was most recently with Royal Bank of Scotland - initially as Managing Director & Co-Head of the Investment Bank, and subsequently as Managing Director with the International Banking division where he led a team of bankers covering some of the largest corporate clients. He has also spent a year with AIG Private Equity.

Anil has worked on a number of marquee deals in M&A, acquisition financing, IPOs, loan and bond issuances. He was also a senior business approver with credit approval authority. Anil is an angel investor who mentors a few start-ups. He is a member of the Institute of Chartered Accountants of India and the Institute of Cost & Works Accountants of India. He holds a Master’s degree in Commerce from Bangalore University. |

Kalpana Sindhu has over 25 years of experience in Corporate & Investment Banking and IT space. She has worked with DBS Bank, Deutsche Bank, Infosys, Citibank and CRISIL in multiple roles across different geographies. She has extensive experience in Strategy Formulation and Implementation, Business Development, Stakeholder Management, Financial Analysis and Advisory, Risk Management and Training/ Mentoring. She has worked on multiple unique transactions in the areas of Working Capital Advisory, Cash Management, Trade Finance (including supply chain financing), Debt Capital Market, Equity Capital market, Structured Finance, Export Credit Agency (ECA) Finance and Distressed Asset Refinance. She has done her PGDM from Indian Institute of Management, Ahmedabad and BE (Computer Science) from Delhi Institute of Technology (now known as Netaji Subhas University of Technology, Delhi).

|

Girichandra Kuchangi has over 17 years of experience spread across Investment Banking, Software Engineering and Start-ups. Girichandra has advised a diverse set of corporates on their M&A and capital market transactions when he was part of Investment banking teams in a few multinational banks in India/HK. His transaction experience spans a range of deal sizes & sectors, including healthcare, financial services, industrials, energy & infrastructure. More recently, Girichandra has been part of leadership teams in a few tech-startups in Bengaluru, focusing on fund-raising and scaling of those businesses. Girichandra holds an MBA from IIM Calcutta and is a Computer Engineering graduate from National Institute of Technology, Surathkal (NIT-K).

|

Natasha Kothari has over 8 years of experience in Corporate & Investment Banking with the Royal Bank of Scotland. She has gained valuable experience in financial modelling, rating analysis and structured solutions. She has been a key member on various high value transactions in the infrastructure and chemical sector. Natasha has a sound understanding of business dynamics of the Investment Banking industry as well as the risks associated with them. She has done her Master’s in Business Administration from S.P Jain Institute of Management & Research with a specialization in Finance. She has a unique distinction of winning a silver medal for India in the Asian Roller Skating Artistic Championship at Akita, Japan.

|

Bhavi Desai has over 5 years of experience in legal documentations, negotiations, legal advisory and legal risk and compliance across multiple sectors including Media, Infrastructure, Information Technology, Services Industry . During her recent stint with Matrix Publicities and Media India Pvt. Ltd, a company under the WPP Group, she was a part of the central legal team and was involved with legal documentation, negotiations and risk analysis for Matrix as well as other WPP companies such as GroupM Media India Pvt. Ltd. ( including it's agencies) and Mediacom Communications Pvt. Ltd. Bhavi holds a LLb degree from Mumbai University and a Bachelor's Degree in Commerce from R.A.Podar College of commerce and Economics.

|

Sharan Vora has over a year and a half of experience in the Venture Capital space and has recently graduated with a Bachelor of Science in Finance (BSc Finance) from NMIMS, Mumbai. As a part of his research project Sharan was involved in creating data trained models for assessing risk taking characteristics of various individuals. He is a CFA aspirant and a travel enthusiast.

|

External Board Members

External Board Members

Dr. Ganesh Natarajan is Executive Chairman and Founder of 5F World. He has two significant corporate success stories to his credit - APTECH and Zensar Technologies, a global software success story which he led as its Vice Chairman & CEO till early 2016. He was the Chairman of the NASSCOM Foundation and President of the HBS Club of India, and is a member of the National Council of CII.

|

M. A. Ravi Kumar alias MARK is a seasoned senior international banker who worked in SBI, StanChart and Citi for over 3 decades in Asia, Europe and the Americas. He then ran the American India Foundation as its CEO and President during 2012-2016 based out of New York. He and his wife Sudha Ravi have been early stage investors in many ventures including I-Flex, Mu Sigma and 1Crowd.

|

Nirav Jogani is the Vice Chairman of RSM Astute Consultech Pvt Ltd, where he leads the Gems & Jewellery practice, Technology Solutions practice and Gujarat operations. His key expertise lies in taxation, audit / risk management, operations consulting and IT. He is a senior Chartered Accountant and ISO lead auditor, and has undertaken advanced training on Japanese management practices.

|

Sujit Banerji is an independent advisor on corporate strategy to a number of companies in the finance and finance-related technology sectors. He comes with substantial experience in running re-structurings, and in steering turnaround situations. He has held prior directorships in companies in Bhutan, India, Sri Lanka, and the United Kingdom. In 2009, he completed a 33-year career at Citigroup, where he had been a Managing Director since 1996 and Senior Credit Officer since 1993; latterly serving as the Head of Strategy & Institutional M&A for Europe, the Middle-East & Africa ("EMEA").

|

|

Deal Origination |

|

|

|

|

|

|

Ecosystem |

|

|

Capital Raising |

|

|

|

|

Co-Investment |

|